Understanding Option Chains

Trading in the options market is often more nuanced than stock trading. If you are an aspiring or practising options trader, options chains can help you understand the market better and place informed rather than impulsive trades.

In this article, we'll explore what an options chain is and what it can tell you.

What is an Options Chain?

An options chain (also called an options chart or options matrix) is an extensive list of all the options contracts for a given underlying security or asset. It gives you a bird's eye view of the prevailing options market conditions.

What Information Does an Options Chain Provide?

An options chain does not show you only a list of the options contracts. It also displays a wealth of other information about each contract. Check out what you can find in a typical options chart or chain.

Spot Price

The spot price is the price of the security or underlying asset in the cash market. This is important because it helps you compare the strike prices of different options contracts with the current market price of the underlying security. Based on this, you can select options that are likely to expire worthless or likely to be profitable for buyers.

Type of Options

The option chain is divided into two distinct sections — one each for call and put options. The left side of the option chart or chain is generally reserved for call options, which give the buyer the right to buy and the seller the obligation to sell the underlying asset at the strike price. The right side is reserved for put options, which give the buyer the right to sell and the seller the obligation to buy the underlying asset at the strike price.

Strike Price

The strike price is the price at which an options contract can be executed. You can compare the strike prices in the option chain with the underlying asset’s current market price to determine the moneyness of options, as outlined below:

In-the-Money (ITM) Options

Call options are labelled as being in-the-money if their strike prices are below their spot prices. Put options are termed as being in-the-money if their strike prices are higher than their spot prices.

At-the-Money (ATM) Options

Both call options and put options in an option chain are considered to be at-the-money if their strike prices are equal (or nearly equal) to the spot price.

Out-of-the-Money (OTM) Options

Call options are considered to be out-of-the-money if their strike prices are more than their spot prices. Put options considered to be out-of-the-money if their strike prices are less than their spot prices.

Options Premium

This is the price that the options buyer must pay to the options seller when purchasing the contract. ATM and ITM options tend to be costlier than OTM options because they are more profitable for the options buyer. In any given options strategy, if an options contract expires worthless or if it is not exercised by the buyer, the premium is the maximum profit for the options seller.

An advanced options chart shows you not only the options premium on any given trading day but also informs you of the change in the premium from the previous trading session in both amount and percentage. This helps you understand if an options contract is becoming more expensive or affordable.

Expiry

You can also select the expiry date in the options chain of your preferred options contract. This is the date on or before which an options contract must be executed. As an options contract approaches its expiry, its value decreases at an accelerated pace. This is because of the time decay in options.

(Put-Call Ratio) PCR

In an options chain, you will also find information about the put-call ratio. It is calculated by dividing the number of put options by the number of call options for an asset.

A high PCR means that more put options are being traded than call options. This is indicative of a prevailing bearish sentiment in the market. Conversely, if the PCR is low or falling, it means the market is mostly bullish.

Volume

This is essentially the number of put options or call options with a specific strike price that are sold or purchased in the market. The trading volume is generally higher for ATM and ITM options and lower for OTM options. You can check the trading volume in the options chain to get a clear insight into how liquid or illiquid an options contract is.

Max Pain

The max pain in an options chain is the price at which the maximum number of options (both puts and calls) are traded. So, if the market moves adversely, the options that are traded at this price will cause maximum pain (hence, max pain) for traders.

Implied Volatility (IV)

In an options chain or options chart, you can also find information about the implied volatility of an options contract. This is simply a measure of how the market expects the price of a security (or underlying asset) to move in the future.

High implied volatility means the market expects an option’s price to fluctuate significantly in the coming trading sessions. Such fluctuations increase the chances that the options contract may end up in-the-money, so it leads to higher options premiums. Conversely, low IV implies that the underlying asset's prices may not fluctuate significantly, so it makes the associated options less popular (and therefore, more affordable).

Open Interest (OI) and Change in OI

Open Interest (OI) in an options chain tells you about the number of open or unsettled options contracts for any given underlying asset. Additionally, you can also track the change in OI in an options chart or chain.

An increase in the open interest of put options means that more traders are buying these contracts — indicating a potential bearish sentiment in the market. A rise in the open interest of call options means that more traders are buying these derivatives — indicating a growing bullish mood in the market.

Conversely, a decrease in the OI of calls (or puts) may indicate a bearish (or bullish) trend reversal. Alternatively, it may also signal indecision in the market.

Options Greeks

In addition to all the above-mentioned information, advanced options chains also show you the options Greeks, which quantify how much an option's price is impacted by various external factors. The options Greeks commonly included in an options chain include the following:

- Delta

The delta tells you how the price of options changes when the price of the underlying assets changes.

- Gamma

The gamma shows you how the price of options changes when the delta changes.

- Theta

The theta quantifies the time decay of options and shows you how the price of options decreases as expiry draws closer.

- Vega

The vega helps you understand how much an options contract is impacted by fluctuations in the implied volatility of the underlying asset.

Conclusion

This sums up the meaning of an options chain and all the details it offers. If you plan to trade in the derivatives market, understanding and using options chains is an essential part of the process.

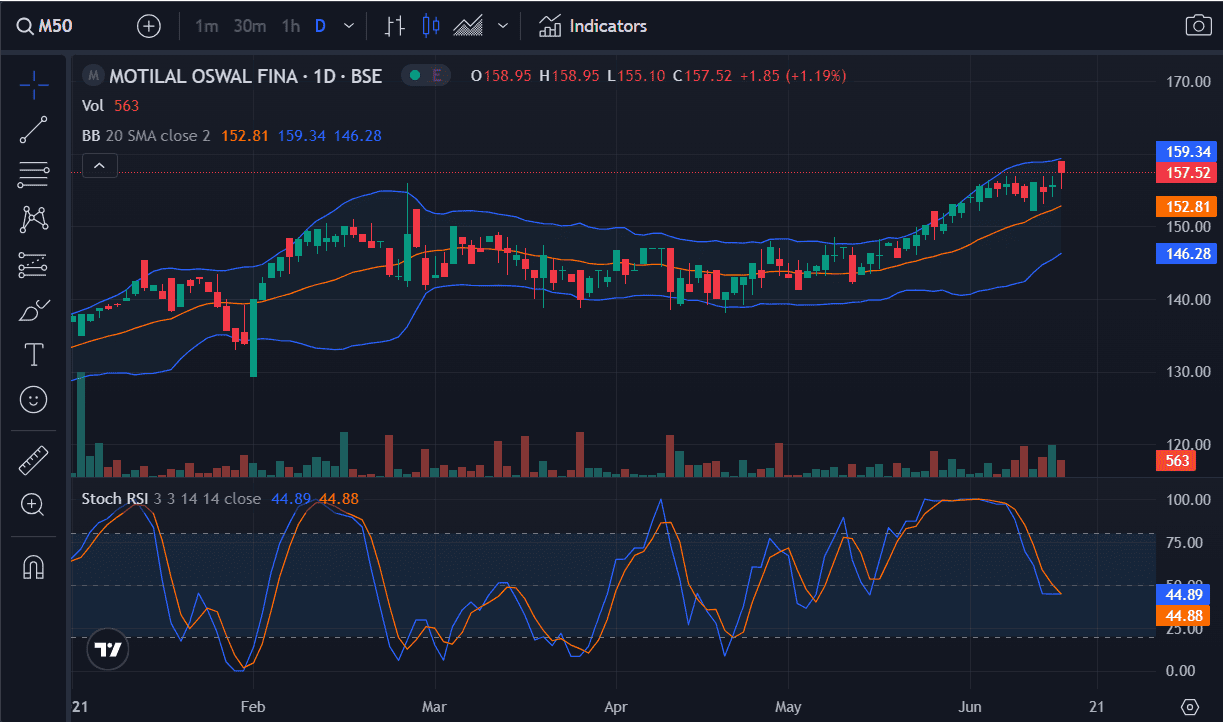

You can access advanced options chains for all options contracts for free on the Research 360 platform by Motilal Oswal. In our advanced options charts, you will find all the metrics outlined above and more, so you can make informed trades in the derivatives market.

Related Blogs

View more-

What happens after a company gets delisted?09 Jul, 2025 16:34pm

-

What Is Industry Analysis and How To Do It?09 Jul, 2025 16:25pm

-

Advantages and Disadvantages of Online Trading09 Jul, 2025 16:20pm

-

Key Insights from Q4 FY24 Earnings for Indian Stock Markets & Sectors09 Jul, 2025 15:34pm

-

What is Beta in Stock Market?09 Jul, 2025 16:02pm

Blogs

View more-

-

Temp110 Jul, 2025 16:00pm

Temp110 Jul, 2025 16:00pm -

test test 1010 Jul, 2025 01:00am

test test 1010 Jul, 2025 01:00am -

What happens after a company gets delisted?09 Jul, 2025 22:04pm

What happens after a company gets delisted?09 Jul, 2025 22:04pm -

What Is Industry Analysis and How To Do It?09 Jul, 2025 21:55pm

What Is Industry Analysis and How To Do It?09 Jul, 2025 21:55pm -

Advantages and Disadvantages of Online Trading09 Jul, 2025 21:50pm

Advantages and Disadvantages of Online Trading09 Jul, 2025 21:50pm -

Key Insights from Q4 FY24 Earnings for Indian Stock Markets & Sectors09 Jul, 2025 21:04pm

Key Insights from Q4 FY24 Earnings for Indian Stock Markets & Sectors09 Jul, 2025 21:04pm -

What is Beta in Stock Market?09 Jul, 2025 20:58pm

What is Beta in Stock Market?09 Jul, 2025 20:58pm